Quicken 2015 Mac Manual

Home›Quicken for Mac›Errors and Troubleshooting (Mac)

I'm worried about what will happen when I set this up and start importing transactions:

Will it try to clear out the last 5 years of transactions that are already in there?

Will it duplicate the last 5 years of transactions?

When I download my account updates every month (OK, every 6 months, who am I kidding), how do I match the payment from the checking account to the mortgage payment that was imported from my mortgage bank so that there aren't two of them?

Thanks!

Comments

- These are some help guides I prepared for users new to Quicken for Mac 2015.

- Aug 24, 2014 Getting Familiar with Quicken for Mac 2015 Quicken for Mac. Unsubscribe from Quicken for Mac? Quicken for Mac 2016: 12-Month Budget - Duration: 6:37.

- Jun 25, 2019 Quicken Updates for Mac. Quicken will check for the latest Mac updates and prompt you to start the update process. Note for Quicken Mac 2015 users: If you purchased Quicken Mac 2015 from the App Store, your update procedure has changed.

User Guide Quicken For Mac 2015.pdf - Free download Ebook, Handbook, Textbook, User Guide PDF files on the internet quickly and easily. Nov 29, 2018 Quicken Mac 2018 is a glorious flaming waste of time if you want a semblance of tracking investments. I have been using Quicken Mac since 2004. I have diligently been forced into upgrading purely because mac has improved with time and no longer can run older versions of Quicken. I am now on the 3rd round of customer service calls. It used to do this. I had Quicken 2015 for Mac. Had to upgrade to Quicken 2018 and it no longer works. The online instructions must be for old software because they make reference to a tab that doesn't exist. VERY FRUSTATING. This is such a basic request. Windows Tricks for Quicken 2015 Users. (Windows then places the minimized program on the taskbar.) To maximize the Quicken desktop so that it fills the entire monitor screen, click the middle button in the upper-right corner of the application window if the button shows one window.

- edited December 2017I don't have an answer -- but I would recommend backing-up your file before you take the plunge.

- edited December 2017

Good idea.I don't have an answer -- but I would recommend backing-up your file before you take the plunge.

- edited August 2018Most of the users here recommend to NOT set up a mortgage for downloading. Then you will not be able to make any manual entries to it or edit it if the interest doesn't come out right.

Here's an answer from another user UKR on this post, https://getsatisfaction.com/quickencommunity/topics/no-transactions-shown-in-payment-details

For whatever it's worth ... I would not bother attempting to activate a loan account for downloading.An online-connected loan or mortgage account does NOT have a transaction register. All data shown in the account come from whatever information the bank downloads to you ... if this process works at all.

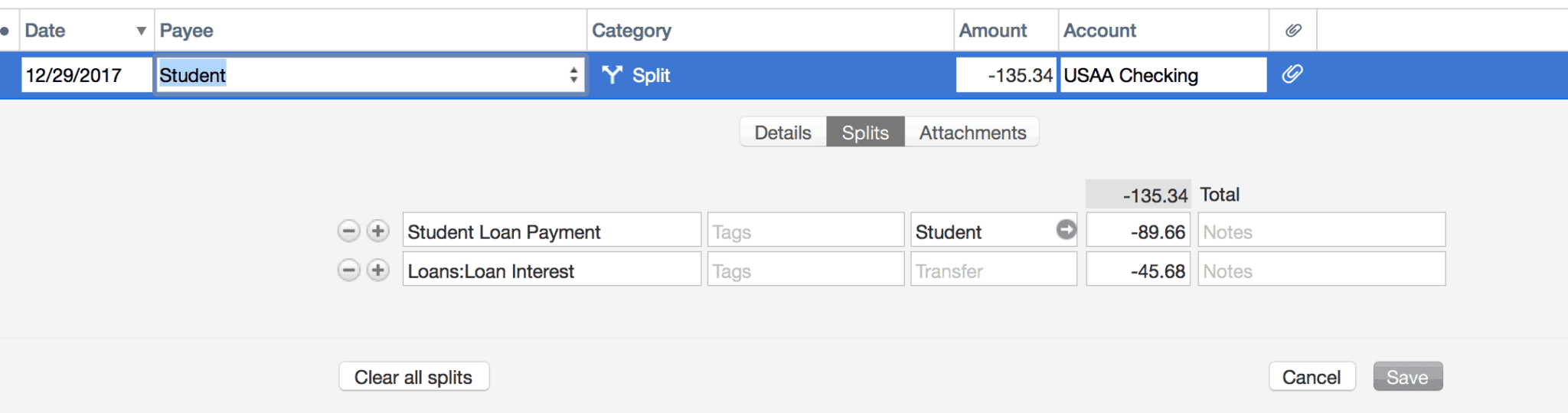

As a result of this, the scheduled payment transaction cannot transfer the amount of principal paid into the (non existent) account register and must use a category, usually something like Loan:Principal, instead.

If you want to have full control over both the loan account register and the payment transactions set up your loan account as a 'manual loan account'. - edited December 2017

This is true on the Windows side...is it equally true on the Mac side?Most of the users here recommend to NOT set up a mortgage for downloading. Then you will not be able to make any manual entries to it or edit it if the interest doesn't come out right.

Here's an answer from another user UKR on this post, https://getsatisfaction.com/quickencommunity/topics/no-transactions-shown-in-payment-details

For whatever it's worth ... I would not bother attempting to activate a loan account for downloading.An online-connected loan or mortgage account does NOT have a transaction register. All data shown in the account come from whatever information the bank downloads to you ... if this process works at all.

As a result of this, the scheduled payment transaction cannot transfer the amount of principal paid into the (non existent) account register and must use a category, usually something like Loan:Principal, instead.

If you want to have full control over both the loan account register and the payment transactions set up your loan account as a 'manual loan account'.

If you find this reply helpful, please be sure to click 'Like', so others will know, thanks.

(Canadian user since '92, STILL using QM2007)

Have Questions? Check out these FAQs:- Quicken Windows FAQ list

- Quicken Windows FAQ list

- edited January 2018Thanks for the tip. The original post mentions a scheduled payment transaction but I'm wondering if I can somehow automatically import the downloaded payment from my checking account to the loan if I set it up as manual. I deleted all my automated quicken entries when I started downloading transactions from my checking account because the automated transactions were duplicated with the downloaded checking account transaction.

What I'm trying to accomplish is that when Quicken sees my mortgage payment transaction from checking, it automatically splits it into the correct categories and deducts the correct principal from my mortgage account. - edited March 2018It used to do this. I had Quicken 2015 for Mac. Had to upgrade to Quicken 2018 and it no longer works. The online instructions must be for old software because they make reference to a tab that doesn't exist. VERY FRUSTATING. This is such a basic request. I'e been a quicken user since it came out and this previously worked fine (except you always had to open the loan file and 'make a payment'.... then reconcile checking account... now if it works I have no idea how. ANYONE?

When it comes to finding a tool to help you track and manage your money, these days are so many choices it can be overwhelming to choose. There are many excellent online personal finance tools, hundreds of mobile apps, powerful spreadsheet budgets (and many good free ones, too).

The personal finance software that started it all, of course, is Quicken. This fall, Intuit rolled out a new version – Quicken 2015 for Mac.

Over the last seven years blogging for Money Under 30 I’ve tried dozens of different personal finance apps from Mint, Intuit’s free online app to iBank – a powerful Mac desktop software that competes directly with Quicken.

In my 20s, when my finances were fairly simple (my biggest concerns were staying on budget and planning my debt payoff), I preferred tracking things with simple spreadsheets I created myself. Now that I’m married, own a business, a home and a growing investment portfolio; these tools are becoming more and more valuable.

I’ve found Personal Capital to be indispensable for managing my investments and making decisions regarding keeping my asset allocation in balance, but I haven’t logged on enough to use its budgeting and spend tracking features.

But today, a couple weeks after downloading Quicken, I’m pretty hooked.

Quicken 2015 for Mac: Good basic money management, but not a whole lot more

There’s nothing revolutionary about what Quicken 2015 for Mac does – you sync your bank, credit cards and investment accounts and the software automatically categorizes transactions and gives you colorful reports that breaks down your income and spending.

But the new Quicken does this very well.

No software is perfect – and reading reviews on Amazon and elsewhere it seems users have had problems syncing accounts with Quicken 2015 – but in my experience the sync process when more smoothly than with other products I’ve tried.

I was also impressed with Quicken’s auto categorizations. Most other programs haven’t categorized transactions very well, leaving you hours worth of tedious manual categorizing if you want everything categorized properly.

I’d say Quicken correctly categorized over 90 percent of my transactions, and I cleaned the rest up in about 30 minutes. (Quicken makes it easy to select multiple transactions and categorize them at once).

I synced four bank accounts, three credit cards, and about 10 investment accounts in another 30 minutes. There was one glitch syncing my Vanguard investments (the software overstated the balances), but I received an email from Vanguard that the problem was on their end. I deleted and reconnected the accounts today and all looks good.

As I ran into, some smaller banks are behind on letting aggregators like Quicken download transactions. My business checking account didn’t auto-sync, but there’s a silver lining: Quicken’s file format is an industry standard, meaning all banks let you download transactions in a Quicken file, which Quicken 2015 uploaded in 30 seconds. The only downside is this account won’t auto-sync, I’ll have to manually upload new transactions every month or so.

Why you might use Quicken

The big advantage to using software like Quicken is to get the big picture of all of your finances. If you sync all of your accounts, Quicken calculates your net worth in real time and doesn’t lie – you know if you’re building wealth over time or slipping.

Secondly, one of the best ways to get a handle on your spending is to see where your money actually goes. As you probably know, budgeting and manually tracking every penny you spend is an exhausting effort that most people have a hard time sticking with. But just like you should count calories if you want to eat fewer than you burn, Quicken can help you ensure you’re spending less than you earn.

The reports in Quicken 2015 for Mac are effective, if basic. I’ve read complaints that this version is missing many reports and features that were available in the old Quicken for Mac 2007 and Intuit admits that more features will be added that aren’t in this initial release.

One thing I’d like to see, for example, is an easy way to exclude a category from reports. I aggregated both my business and personal accounts so I’d like to be able to run reports that don’t include business expenses.

Although I’m not currently using them, Quicken offers a bill reminder and a goal-setting tool that will send you email or mobile reminders.

Advantages over free personal finance managers

At $75, Quicken 2015 for Mac isn’t cheap. But the price of buying software gives you a couple of advantages over free online options.

Security

Although all financial web and mobile apps feature strong encryption, they still aggregate your financial data in the cloud. With Quicken, the links to your bank accounts are stored on your local computer. If you password-protect both your computer and your Quicken file, it’s conceivably a safer way to store your data than in the cloud. Quicken offers a free mobile app to view your account balances and transactions on the go, but again, this exposes your data to the cloud, so proceed accordingly.

Speed

Quicken does seem faster at syncing data than online tools. Although web apps have come a long way, I still find it more cumbersome to edit transactions via a web interface than with desktop software. The small difference may not bother some people, but for me, that’s a plus.

Transferability

As I mentioned before, the Quicken file format is a standard in the financial industry, meaning it’s easy to import and export data from the software. If you change computers or even decide to use a different personal finance manager in the future, it should be straightforward to move your Quicken data in a few clicks.

Quicken 2015 Mac Manual