Quickbooks 2010 Manual Payroll Mac

Customer Book Reviews

- Manual Payroll In Quickbooks Pro

- Quickbooks Payroll Manual Pdf

- Quickbooks 2010 Manual Payroll Machine

- Quickbooks Manual Payroll Setup

- Free Quickbooks 2010 Manual

- Turn On Manual Payroll Quickbooks

A financial application that also manages your company's bank accounts and investments, QuickBooks 2010 runs on both PC and Mac platforms. QuickBooks 2010 for Mac 2010 is compatible with any Mac.

I found the QB2010 program VERY complicated and not terribly intuitive, but this book really helped. I was able to learn the basics very quickly and then use it as a reference to look up specific tasks. The index is very complete. I can't compare it to other books about QB2010 since I've never used anything else, but I can't imagine I'd need anything else anyway. The screenshots were good, too -- large enough to see clearly.

Just purchased Quickbooks for Mac program and wanted a reference book to assist in the learning curve, so I purchased 'The Missing Manual'. The one issue I have is the book as featured on Amazon does not indicate it only covers Quickbooks for Windows. The book I received has a different cover, one that has an oval orange colored graphic to the left of the dog's tail stating 'Covers QuickBooks for Windows'. On page 4 of the book it states 'Warning: QuickBooks for Mac differs significantly from the Windows version, and unfortunately you won't find help with that version of the program in this book.' It would be nice to know that before I invested in the book. I suppose I will get some benefit from the book in terms of concepts, but I will still have to figure out how to use the Mac version on my own. I cannot understand why Mac users are constantly short changed by companies that cobble a Mac version together and then not support it with quality manuals. Even the 'official' QuickBooks manual from Intuit states it only covers QuickBooks Pro.

- QuickBooks can handle many of the financial tasks small companies face. QuickBooks 2010: The Missing Manual helps you handle QuickBooks with easy step-by-step instructions. Set up your QuickBooks files and preferences to fit your company; Track inventory, control spending, run a payroll, and manage income.

- QuickBooks will provide you with payroll summaries - excellent for manual preparation of Payroll tax returns without purchasing the tax tables. But without purchasing the service, QuickBooks will not calculate the deductions for each paycheck or prepare the Quarterly payroll tax forms.

This book explains things with the perspective of YOU the business person in mind. Very clear, very detailed, accurate, organized, and loaded with EVERYTHING you need to know from getting started to dealing with payroll, to finishing out the year with closing entries and taxes. I recommend this book to anyone learning quickbooks, and as supplement for anyone who already uses quickbooks, but would like to learn more. In my opinion, it is the best out there for your money.

Best book on Quickbooks, best physical book design

By E. D. Van Dorenon Aug 15, 2011

This book is quite thorough and logical, considering the complexity of the software being described. I teach written communications, and IMO, the design of the book - both the layout and the physical construction (it lies flat on the desk when open!)are outstanding. I have several of the Missing Manual series, and they're all great. I use the Microsoft Project book, which is written by Bonnie Fiore, the author of this QuickBooks volume, and she's really good at ' 'splainin' ' rich, complex applications like QuickBooks and Project. She knows her target audience (the first rule of communication), and she is clear and succinct - and humorous. Accounting and project management both need humor.

This book has come in very handy while setting up my employer's seventeen companies on QuickBooks. There are some items I wish it covered - like where to find specific solutions for reports (totaling a detail report should be basic); I constantly have trouble finding a way to get what I want. The older versions of QB were easier to work with on this level. All in all, this book is well worth the price.

As a small business owner I turn to this book over and over again to help me clarify what I am doing. I like the easy explanations that I have been able to translate into checklists for transactions that occur frequently. I would highly recommend this book.

Better than official manual but incomplete. I'm experienced but still always learn from The Missing Manual books. Worth the price.

Excellent report from the giftee. Book is well writtednand helpful. First learning experience with Quickbooks.

Not as basic as 'For Dummies' books, but still a good reference

By Woohooon Dec 13, 2009

As a Quickbooks first-timer, I needed something because I was a little confused and frustrated. This book is a good reference book for those times when I just couldn't figure it out on my own. It is similiar to the actual Quickbooks Help option that is included with the program. It is NOT as basic as the 'For Dummies' books, however.

If you don't know anything about setting up the accounts, don't buy this textbook. It explains about the accounts in general such as petty cash but it doesn't explain how or where you will be recording the expenses of petty cash. This is just one example of many. There is another thing; it doesn't cover anything about depreciation which I believe is one important topic to be mentioned on this textbook. And finally, the topics are all mixed up. It brings you back and forward with the page numbers. All topics are not covered in one page only; they are divided in many parts all over the book. It's very disappointing!!!

As a CPA who has had experience working with various accounting software products but, at the time, new to Quickbooks, I found this book to be a fantatic step-by-step guide to setup your company file, lists and items with detailed instructions and insider tips. This book effectively conveys the sometimes technical language and processes of accounting in a way that allows users to understand some of the 'behind the scenes' things in Quickbooks and, more importantly, how to best utilize the software. For those who are more advanced Quickbooks users, there are chapters about running specific, detailed reports to customizing Quickbooks to your business. I would definitely recommend this book to anyone looking to get more out of their Quickbooks accounting software.

Thorough Step by Step approach to QuickBooks Software

By M. Crosbyon Jan 28, 2010

Really well done step by step approach to the latest QuickBooks version. I have used QB for many years but this is full of surprises and shortcuts.

So, I bought this book at the same time I bought QB 2010 for Mac. I wasn't really thinking that it would be for the PC version of QB 2010 when I bought it. That said, the books step by step and section by section guide to setting up and using QB 2010 translated well to the Mac world. Sure I would have liked a book specifically for the Mac (which you do get by the way as a FREE download when you buy QB 2010 for Mac, found this out after the fact), but all in all it was nice to have a physical book in hand to be able to address certain sections/situations. This would be a great book for the PC QB 2010 user and is a nice to have to for the Mac QB 2010 user.

For anyone who has never used Quickbooks before THIS is the book to buy! It's got everything i've needed to survive!

Book was fine but went with online version.

Manual Payroll In Quickbooks Pro

The condition of the book was exactly as it was represented to be. It has helpedme become more familiar with Quick Books and has helped me handle some troublesome situations. I'm very happy I got it.

I found that I should have studied harder when I took accounting in college. Double entry accounting is not for me. I just couldn't utilize it. My fault...not the books.

It helps me to find any information and clear a lot of doubt that I had. I can return to it every time I want and I can carry on the book to any place, when I am doing other things.

worked just fine

Related Articles

- 1 Change an Existing Employee's Withholdings in QuickBooks

- 2 Add Employees in QuickBooks

- 3 Garnish Wages in Quickbooks

- 4 Where to Enter Vacation Hours in QuickBooks Pro

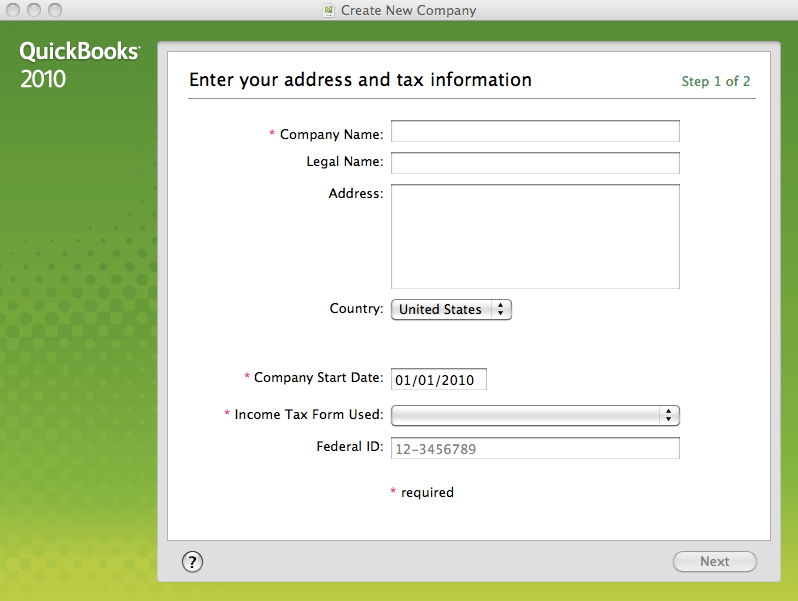

QuickBooks for Mac does not have a built-in payroll service like the Windows version. When you click the Payroll link you are taken to an external website for processing employee checks. Since QuickBooks doesn't provide a built-in method for manually tracking payroll, employers who want to track payroll for employees in QuickBooks must subscribe and pay a monthly fee to access the online QuickBooks Payroll for Mac service. Before enrolling in the QuickBooks payroll system, make sure each employee's name is spelled exactly how you plan on spelling it for paychecks. If the data between QuickBooks and QuickBooks payroll don't match, the program won't work correctly.

Edit Employee Information

2.Double-click the name of any employee you need to edit.

3.Change the First, Middle and Last name as necessary to ensure that your QuickBooks Payroll Services account information matches with the employees in your QuickBooks 2013 for Mac software. Click 'OK' to save changes.

Set Up Payroll

2.

Select 'Payroll' and choose a service from the drop-down menu to use for your payroll services. Click 'Edit Account' and sign in or create an account.

Quickbooks Payroll Manual Pdf

3.Select the employees you want to pay from the list of employees by checking the box next to each employee's name.

4.Enter hours worked and other payment information for each employee. In the Run Payroll section of QuickBooks Payroll for Mac there are fields for regular work, overtime, double overtime, sick pay, vacation pay and fixed bonuses.

5.Click 'Create Paychecks' and approve the salaries for each employee.

6.Select the option to print checks by yourself, hand-write checks or send employees a direct deposit of the paycheck for free. Confirm your options and select whether to email employees with a link to the online version of the pay stub.

Warning

- Information in this article applies to QuickBooks 2013 for Mac and QuickBooks Payroll for Mac. It may vary slightly or significantly with other versions or products.

References (1)

About the Author

Quickbooks 2010 Manual Payroll Machine

Avery Martin holds a Bachelor of Music in opera performance and a Bachelor of Arts in East Asian studies. As a professional writer, she has written for Education.com, Samsung and IBM. Martin contributed English translations for a collection of Japanese poems by Misuzu Kaneko. She has worked as an educator in Japan, and she runs a private voice studio out of her home. She writes about education, music and travel.

Cite this Article